Some Of Guided Wealth Management

Table of ContentsSome Ideas on Guided Wealth Management You Should KnowThe Buzz on Guided Wealth ManagementFacts About Guided Wealth Management Revealed10 Easy Facts About Guided Wealth Management ExplainedRumored Buzz on Guided Wealth Management

Right here are four things to take into consideration and ask on your own when determining whether you need to tap the proficiency of a monetary advisor. Your net worth is not your revenue, yet instead an amount that can aid you comprehend what money you earn, exactly how much you conserve, and where you invest money, also., while obligations consist of credit rating card bills and home mortgage settlements. Of program, a favorable net worth is far much better than an unfavorable net well worth. Looking for some instructions as you're evaluating your financial circumstance?

It's worth keeping in mind that you do not need to be affluent to inquire from a financial consultant. If you already have an advisor, you may require to alter experts at some point in your economic life. A significant life change or choice will trigger the choice to search for and employ an economic advisor.

Your infant gets on the method. Your divorce is pending. You're nearing retirement (https://filesharingtalk.com/members/599743-guidedwealthm). These and various other significant life events might trigger the requirement to visit with a monetary expert concerning your financial investments, your economic goals, and other monetary matters. Let's say your mother left you a neat sum of money in her will.

Top Guidelines Of Guided Wealth Management

Numerous sorts of financial experts fall under the umbrella of "financial advisor." As a whole, an economic advisor holds a bachelor's level in an area like finance, accounting or company monitoring. They also may be certified or licensed, depending on the services they use. It's likewise worth absolutely nothing that you might see an advisor on a single basis, or job with them a lot more frequently.

Anyone can say they're a financial consultant, yet a consultant with specialist classifications is preferably the one you must employ. In 2021, an estimated 330,300 Americans worked as individual monetary advisors, according to the U.S. https://guidedwealthm.wordpress.com/2024/07/29/unlock-your-financial-future-super-advice-brisbane-superannuation-advice-brisbane-and-the-best-financial-advisor-brisbane/. Bureau of Labor Stats (BLS). A lot of financial consultants are self-employed, the bureau says. Generally, there are 5 kinds of monetary advisors.

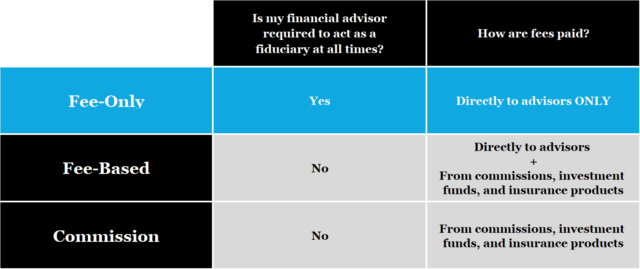

Unlike a registered representative, is a fiduciary that need to act in a client's best interest. Depending on the worth of possessions being handled by a signed up financial investment advisor, either the SEC or a state safety and securities regulator manages them.

The Best Strategy To Use For Guided Wealth Management

As a whole, however, economic preparation professionals aren't looked after by a single regulator. An accountant can be considered a financial coordinator; they're managed by the state accountancy board where they exercise.

Offerings can consist of retirement, estate and tax planning, along with financial investment administration. Riches supervisors generally are signed up agents, meaning they're regulated by the SEC, FINRA and state safety and securities regulatory authorities. A robo-advisor (financial advisers brisbane) is an automatic online financial investment manager that relies upon formulas to look after a customer's assets. Customers usually do not get any kind of human-supplied monetary guidance from a robo-advisor solution.

They make cash by billing a fee for each trade, a level monthly charge or a percent fee based on the dollar amount of properties being taken care of. Capitalists searching for the best advisor must ask a number of questions, including: A monetary advisor that works with you will likely not be the exact same as an economic advisor that works with an additional.

The Facts About Guided Wealth Management Uncovered

Some advisors may profit from marketing unneeded products, while a fiduciary is legally called for to choose financial investments with the client's demands in mind. Deciding whether you need an economic advisor entails evaluating your economic circumstance, figuring out which type of financial consultant you need and diving right into the history of any type of economic consultant you're assuming of employing.

Allow's say you intend to retire (super advice brisbane) in twenty years or send your youngster to a personal college in one decade. To accomplish your objectives, you might need a proficient professional with the appropriate licenses to help make these plans a fact; this is where a monetary expert is available in. Together, you and your consultant will certainly cover several topics, consisting of the amount of cash you ought to conserve, the sorts of accounts you require, the type of insurance you ought to have (consisting of lasting treatment, term life, disability, and so on), and estate and tax preparation.

Excitement About Guided Wealth Management

Now, you'll likewise allow your expert understand your investment preferences too. The initial assessment might likewise consist of an examination of various other economic monitoring subjects, such as insurance policy issues and your tax scenario. The advisor requires to be aware of your present estate plan, along with other professionals on your preparation team, such as accountants and attorneys.